October 2024 Market Snapshots

Key Metrics

Aspen:

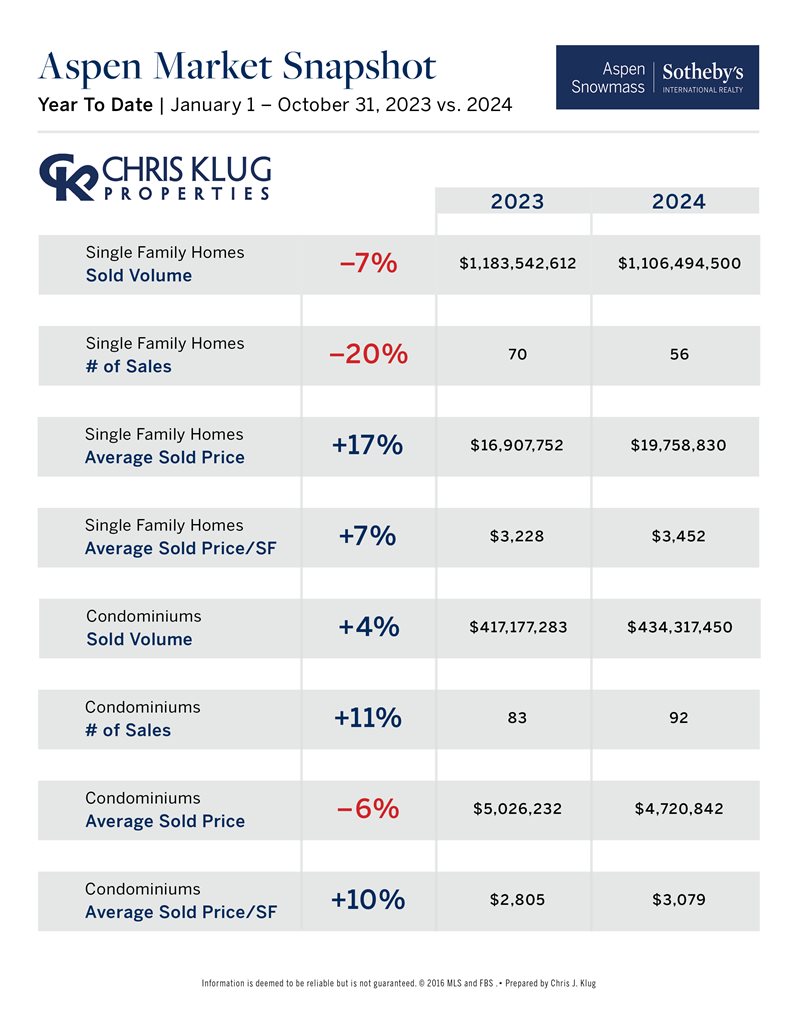

1) Year-to-date (YTD) single-family home volume and transactions in Aspen are lower than a year ago, although pricing has increased. In contrast, YTD condo activity has seen an uptick despite a slight decrease in the average sold price.

2) October experienced significantly lower volume and transactions for condos and single-family homes in Aspen, yet pricing remained robust.

3) $10 million and $20 million sales are slightly below last year’s pace but remain historically strong.

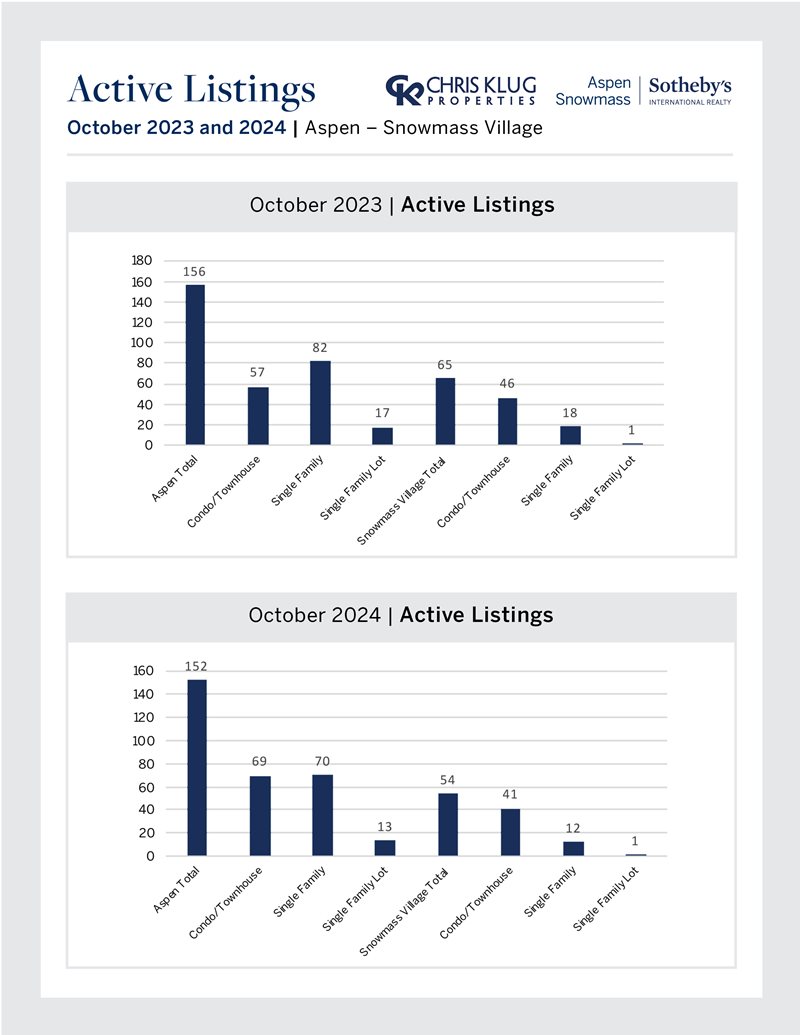

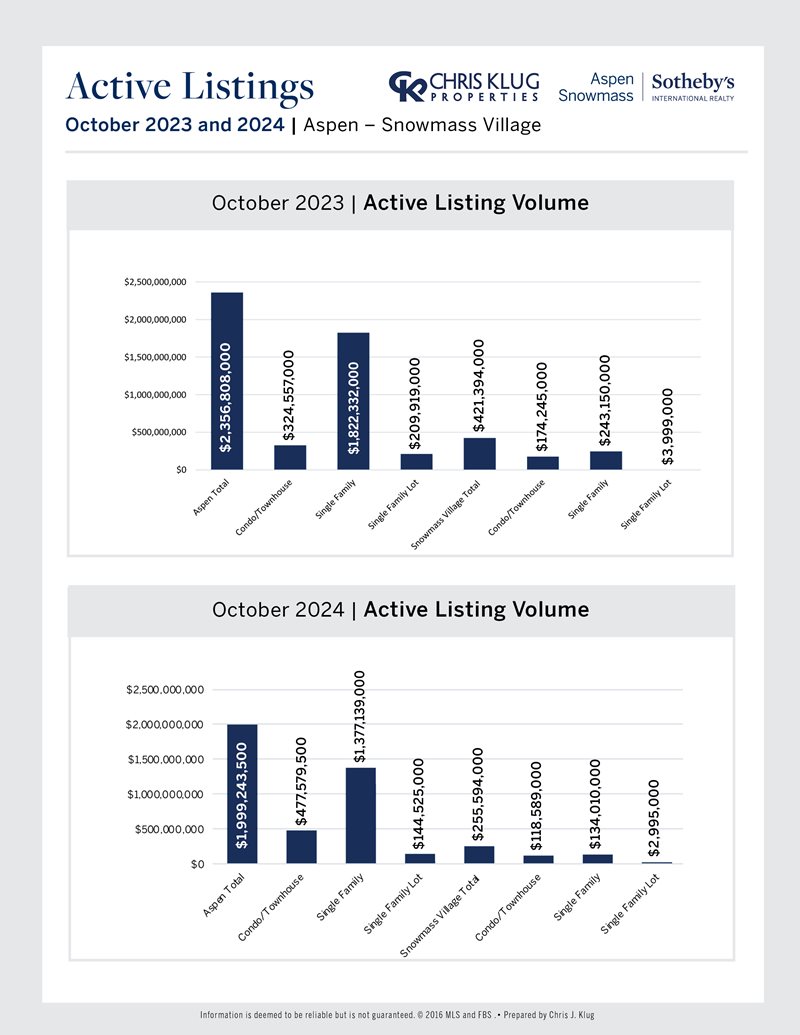

4) Aspen’s inventory for all ownership and free market property types, including vacant land, is nearly unchanged from a year ago but almost 40% lower than in October 2019.

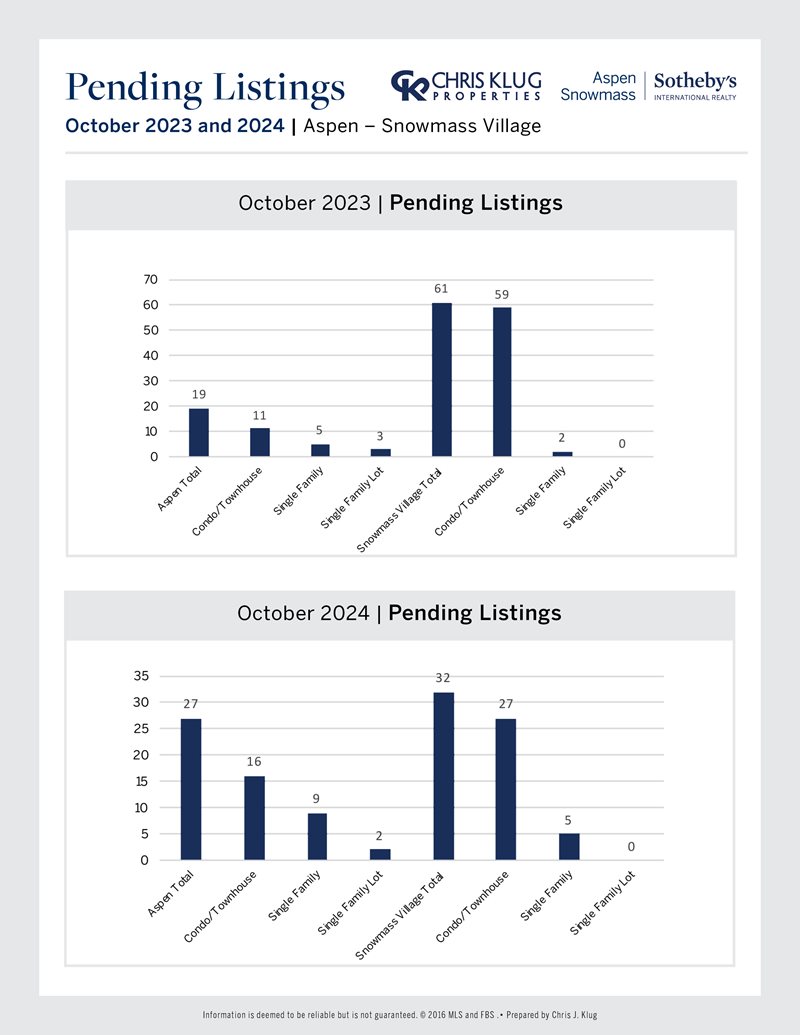

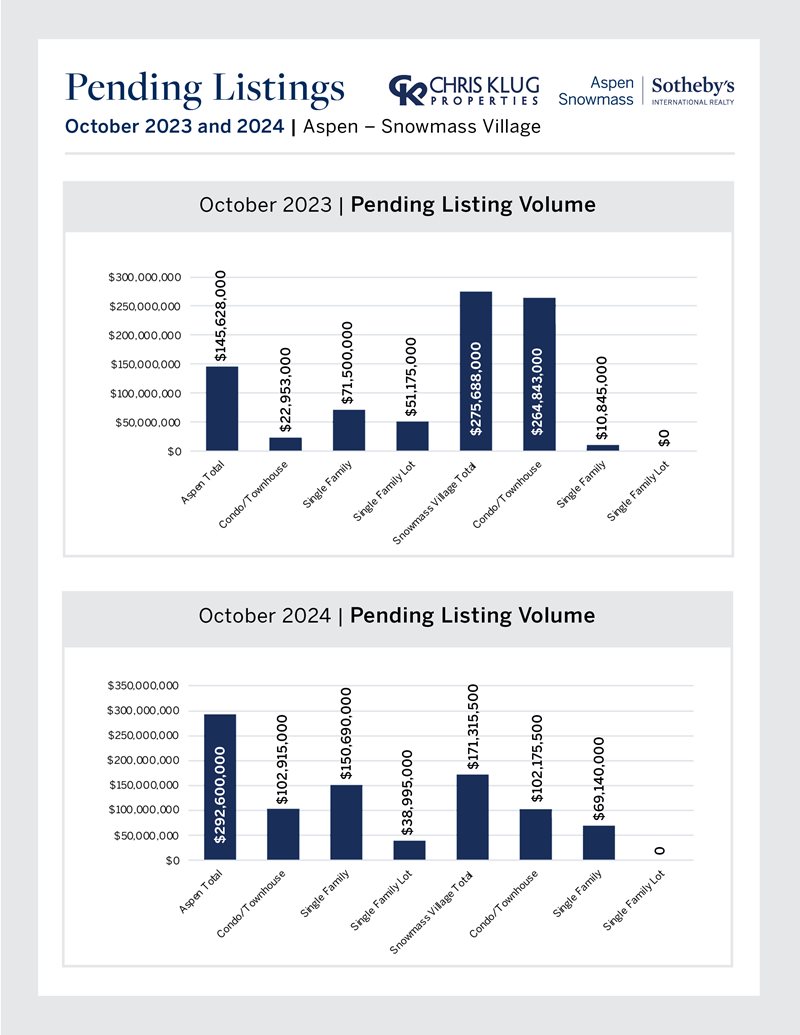

5) Today, 27 Aspen properties are pending sale, totaling $292 million, compared to 19 properties a year ago that totaled $145.6 million.

Snowmass Village:

1) In Snowmass Village, YTD single-family home volume and transactions are down, while pricing has strengthened.

2) The YTD volume of condos has risen by 56%, with transaction numbers remaining relatively stable and pricing increasing significantly, thanks to new product sales at Cirque and Aura.

3) October saw a slowdown in single-family sales in Snowmass Village; however, pricing continued to be strong.

4) Condominium activity in October 2024 was notably stronger compared to October 2023, largely due to the closings of multiple units at Cirque and Aura.

5) The inventory of all whole ownership, free-market properties, including vacant land in Snowmass, has decreased by 16.9% and is down 73% compared to October 2019.

6) 32 properties in Snowmass Village are pending sale, totaling $171.3 million, compared to 61 properties a year ago, which totaled $421 million.